15. November 2022 By Sandra Weis

Contribution assessment ceiling (CAC) set to be raised in 2023 – this also affects company pension schemes

Article 1a of the German Company Pensions Act (Betriebsrentengesetz, BetrAVG) regulates the entitlement to a company pension through the conversion of earnings into pension contributions. This states that the employee has the right to demand that their employee pay part of their future earnings – up to four per cent of the relevant contribution assessment ceiling for the statutory pension fund – into their company pension scheme through said conversion of earnings into pension contributions (deferred compensation). This is an important measure to protect workers from old-age poverty. In the past, the maximum taxable contribution for company pensions could be raised or lowered – generally the former – via an annual adjustment of the contribution assessment ceiling. But Covid-19 changed everything: the contribution assessment ceiling for 2022 has been adjusted – in other words, it will be lowered for western Germany. The German Federal Ministry of Labour and Social Affairs (Bundesministerium für Arbeit und Soziales, BMAS) put together a draft regulation aimed at significantly increasing the contribution assessment ceiling for the year 2023. The Federal Cabinet adopted the BMAS’ draft regulation on 6 October 2022. The approval of the Bundesrat is still pending. This is considered a mere formality since the new calculation basis is derived from the statistically collected income earning capacity of the previous year. The fact of the matter is that increasing the contribution assessment ceiling also has implications for company pension schemes.

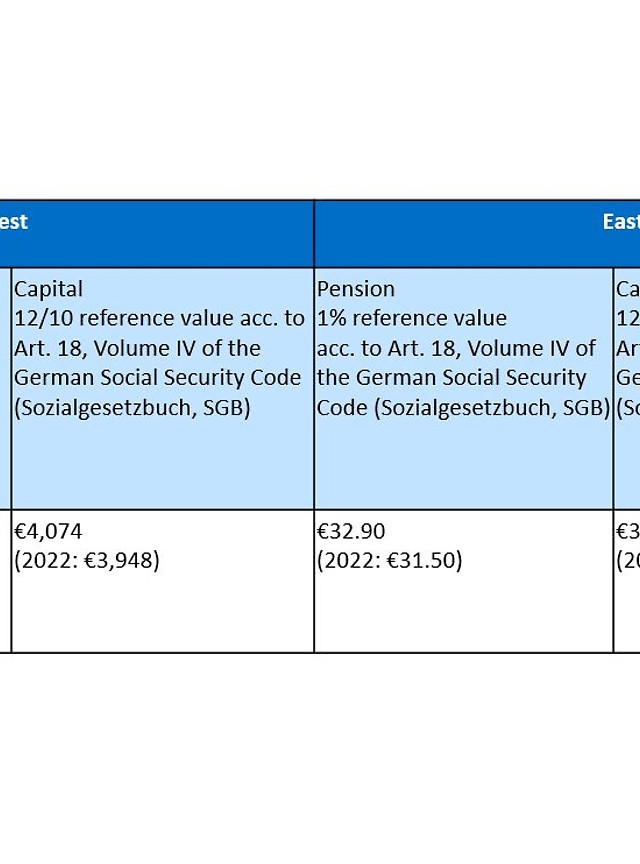

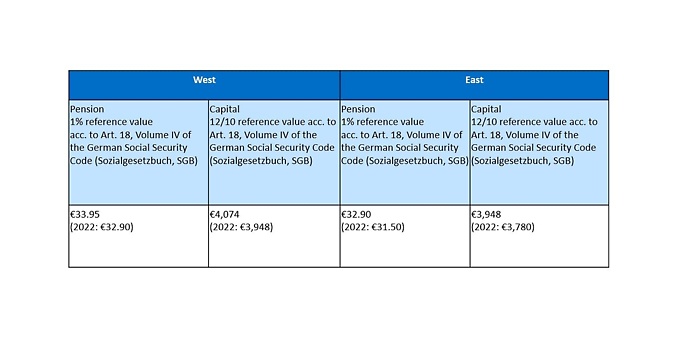

Expected calculation basis for 2023

Pursuant to Article 3(2) of the BetrAVG, vested entitlements may be paid by the employer without the consent of the employee if they do not exceed a de minimis limit. Adjustments will also be made for 2023.

Effects of the adjustment of the contribution assessment ceiling on company pension schemes

Let us assume that an employee agrees with the company that part of their future earnings – four per cent of the relevant contribution assessment ceiling – will take the form of deferred compensation. The employee therefore waives a portion of their gross salary – every month, for instance – and the company pays this as a contribution into a pension fund policy. The German Act to Strengthen Occupational Pensions (Betriebsrentenstärkungsgesetz, BRSG) that came into force in 2018 meant that employers were obliged to support their employees in building up a pension by making a contribution to their deferred compensation if certain conditions were met. Previously, this contribution was only obligatory for new policies dated 1 January 2019 or later. As of 1 January 2022, employers will be obliged to pay this contribution for all existing deferred compensation policies. The employer contribution amounts to a flat rate of 15 per cent of the deferred compensation amount – provided that the employer actually saves the social security contributions.

Implications for employers

If the contribution assessment ceiling is increased, not only will the contribution for deferred compensation be larger (in this case: the pension fund policy), but the amount of employer contribution could also change. The employer is required to take the adjusted amount of deferred compensation into account in payroll accounting. The employer contribution must be adjusted unless it continues to voluntarily pay this at the same, unchanged rate. The new total contribution will need to be paid to the insurance company or the pension provider – in this case, to the pension fund.

Implications for employees

The benefits provided by the insurance company or pension provider resulting from the deferred compensation increases, and the pension gap for the employee decreases. The employee is notified of this in corresponding documentation, such as the addendum to the insurance policy.

Implications for insurance companies and pension providers

Insufficient or a total lack of technical support is often a major challenge for inventory management systems, especially for variable premium products, where payments made to the insurance company or pension provider are included as a boilerplate in the insurance policy. Employers could make contributions that exceed the maximum amount free from social security contributions. The insurance company would then need to find ways to deal with challenges like this.

Information and communication needs

Increasing the contribution assessment ceiling often increases the need for information and communication by means of target group-oriented information processing – namely through various communication channels and especially in light of the fact that the contribution assessment ceiling for 2022 was reduced and is now increasing again.

Solution

The time required for implementation and processing information should be kept within limits. It is important to choose a technical solution that can also be used for future increases in the contribution assessment ceiling. Appropriate measures must be derived. Possible measures for employers and insurance companies or pension providers could include:

- Obtaining professional support

- Improving technical support

- Using a variety of different communication channels

- Preparing documentation such as informational material

Experts with practical experience and extensive business expertise should verify the effects as well as define and, if necessary, implement appropriate measures based on this information. They should be familiar with the topic of company pension schemes and also have technological skills in order to assist in making the necessary changes to the IT systems, such as the administrative system, if necessary.

Would you like to learn more about exciting topics from the world of adesso? Then check out our latest blog posts.