11. May 2022 By Jan Jungnitsch and Ann-Kathrin Bendig

Data Driven Insurance - Digital Business Models holistically automated!

Big data is no longer a foreign concept in the insurance industry. The amount of data continues to grow as digitalisation gathers pace. The challenge for insurers is to generate complete, high-quality data from the vast quantities of information available. This creates a further challenge, namely how to analyse and leverage information relevant to the decision-making process from the vast torrent of data available and do so in a targeted manner in order to maximise added value. Having said that, the added value that is generated must not be limited to a particular segment, division or process, one such example being the use of artificial intelligence to optimise well-defined use cases. Instead, it should be created throughout the company. More specifically, the insurer can make the transition to becoming a data-driven company.

But what is a data-driven insurance company?

A data-driven insurance company makes decisions on the basis of data and the models generated from it. Use of data transcends company boundaries. Beyond that, traditional business structures are becoming blurred with regard to the use of data and the adoption of business models. This gives rise to data ecosystems created from a wide variety of data sources both inside and outside the company. To name one example, data lakes can be deployed to make use of externally available data. These constitute a marketplace of sorts that makes data available or accepts data as a ‘product’.

Sub-aspects such as pricing or risk modelling in particular have always been backward looking, which is the basic tenet underlying the insurance business. Data analysis has been used in the sector for some time now. Data-driven insurance, however, is more about making business decisions based on data and automating them within processes. When it comes to carrying out projects like this, we distinguish between cycles or loops that control internal processes, such as claims or benefits, on the one hand, and product design and pricing on the other.

However, data-driven also means raising awareness for the potential of the data available to an insurer. This asset is not utilised by most insurers. By making use of the data, it is possible to significantly increase the business value over the long term. Because data analysis focuses on specific sub-processes, many insurers simply do not know how much data is available within the company, primarily due to the digitalisation of customer interactions, the quality of the data or that the potential of the data is currently not being fully tapped. Just having data is not enough, though.

Modern data platforms are the cornerstone of data-driven insurance. In step one, data from different sources is made available in a structured or unstructured format so that it can subsequently be refined and used. Once this has been done, it in essence serves as the basis for data-driven services.

With data-driven insurance, insurers can generate significant added value and gain a clear advantage over their competitors. Here’s how:

- Cost optimisation

- Improved customer service by reducing response times (increased efficiency)

- More effective product placement and more targeted products by knowing more about customers

- Continuous improvement of decision-making processes via data objectification

- Standardised decisions independent of professional experience

- Establishing a uniform standard

What are the requirements for data-driven insurance?

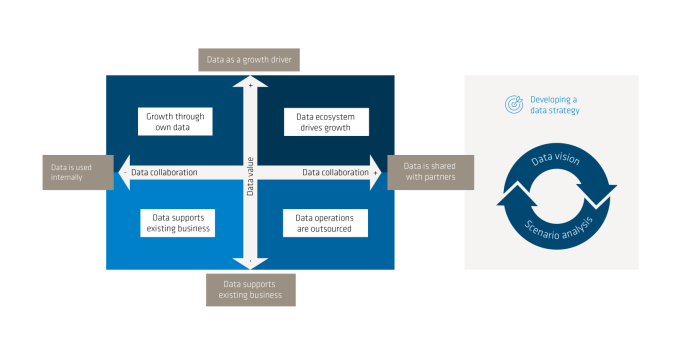

When creating a data strategy, it makes sense to prepare a core data vision with the aid of a scenario analysis. This then serves as the basis for in-depth discussions on the underlying goals and challenges associated with creating a data-driven company.

In combination with potential business models, a portfolio-based assessment, which includes the data value dimensions and the form of collaboration, is a key tool for defining a data strategy.

What is the effect of data-driven insurance on the organisation?

The blurring of traditional corporate structures as this relates to the use of data also has an impact on the organisation and collaboration within it. There are two things that must be done at this point, which are to break down silo thinking and enhance cooperation. Another key step is to fully align the organisation with the value stream. The foundation of insurance providers is being reshaped by the following factors:

- Cooperation between cross-functional teams

- An agile mindset

- Taking personal responsibility

- Enabling decision-making competence

- Putting customer orientation at the centre of product development

Conclusion

What insurers need is a database that they can rely on and use to gain new insights and offer new services. The demands in terms of the quality and quantity of data and how it is managed are growing immensely. Insurers need to rethink their strategies for gathering, storing and processing information to realise the full potential of the data and pave the way for data-driven insurance.

To create the foundation for this, having a database with the accompanying maturity level is necessary. This is often the first hurdle you encounters. Once a company realises that its data is not up to its own standards, it should start creating the conditions necessary to change this. This is a worthwhile investment in the future that really pays off.

You can find more about exciting blog posts from the adesso world here.