14. March 2023 By Markus Borgmann

Digital Commerce Study on Finance – The discrepancy is large: how financial service providers are lagging behind their customers’ wishes

The online business is booming! Companies have increasingly been relying on the Internet as a distribution channel, and it did not just start with the pandemic. If people are buying, they have to pay, too. PayPal has revolutionised online payments and shaken up the industry; embedded finance has found its way into the daily business of banks. This example just goes to show that financial service providers must adapt to this social change. Higher, further, better – the fast pace of society sets the pace, with customers determining how platforms, websites and apps should look. But are banks and insurance providers prepared to keep up with this pace? Will they be major players in the future or simply just envious onlookers?

The adesso Digital Commerce Study surveyed more than 1,000 customers on their purchasing behaviour regarding financial and insurance products and 300 decision-makers from the banking and insurance industry. We wanted to know what customers want and what can companies already provide today? Where are there significant differences and where do providers already offer their customers excellent service? We have bundled these findings into four areas: sustainability, service, online vs. offline, customer acquisition and retention.

In this post, I will deal with the areas of sustainability and online vs. offline in order to give you an initial idea of the study results. I will then summarise the most important findings at the end.

Sustainable financial products: high willingness for higher prices

Sustainability has become a buzzword. Everyone is talking about in almost every industry. Companies advertise sustainable products and want to position themselves as climate-friendly. But what does sustainability mean for customers? Are they willing to pay an appropriate contribution for climate-neutral and sustainable financial products? What role does sustainability play in the corporate strategy? We asked customers and decision-makers, among others, these questions.

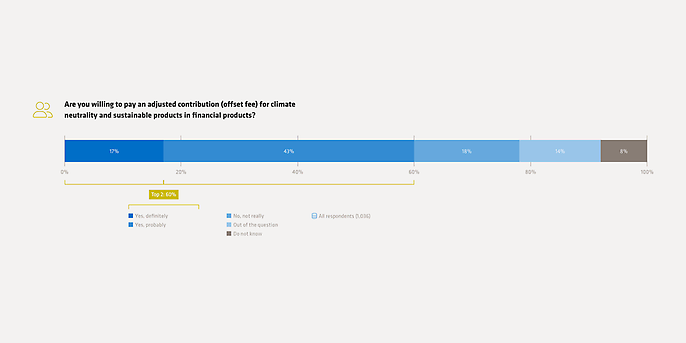

One thing is certain: almost two in three respondents are willing to pay an appropriate contribution for climate neutrality and sustainable financial products (60 per cent). Only 32 per cent would rather not or definitely not do this. Those who act sustainably and offer appropriate solutions can polish up their image, as nearly one in two people say that sustainable behaviour improves the likeability of banks (46 per cent). The situation is similar for insurance providers (44 per cent). However, sustainable behaviour is still far from being perceived as an established standard. Only few respondents say that banks with sustainable operations are the standard (15 per cent), and even fewer for insurance providers (13 per cent).

It is interesting in this context that two in three decision-makers claim that their banking/insurance strategy, or at least part of it, is geared towards sustainability (66 per cent). It is annoying, of course, if customers do not notice this strategic orientation. Is it due to a lack of communication on the part of banks and insurance providers? A lack of transparency maybe? The reasons can be manifold.

Gap alert – when aspiration and reality diverge

So there are clear differences in perception here. It is something that we called a ‘gap alert’ in our study. We show the discrepancy between what customers want and what companies present. In this example, the gap alert is: the potential of sustainable financial products is wasted. The willingness to pay more for sustainable solutions is there, but the opportunity to explicitly address these customer wishes and in turn gain potential new customers is being skipped.

How can companies change this? Sustainability must be used as a sales tactic. The crux of the issue is that financial service providers are still securing competitive advantages in the market currently. In the future, various EU-wide regulations will increasingly determine how sustainable measures are handled. This means that the current activities lose their unique selling point.

Customer communications is also of great importance. Fewer than one in five (17 per cent) of customers would switch from paper-based to digital communications. However, only 5 per cent of the companies specifically approach their customers about this switch. Even if these figures only represent a small part of the respondents, potential to save costs and act more sustainably is definitely being wasted here.

The younger the target group, the higher the online use

Let us now look at the online and offline behaviour of customers and companies. My guess – and I am sure one or two of you know this already – is: that people often search for financial services or insurance offers online. After all, this is the quickest way for me to get information from different providers. Once you have found the right offer, you can sign the contract in a branch office. Many prefer the personal exchange and direct contact with actual people whom they have already met personally. That is the assumption, but what do our respondents say?

Fewer than one in three (60 per cent) takes out insurance policies online, and at least one in two (50 per cent) opens accounts online. In addition to personal preference, age plays a role when it comes to the question of online or offline. People aged 44 and younger, in particular, use digital sales solutions such as provider websites, comparison portals or online banking more often than the local branch office. On the other hand, the bank’s branch office is the most popular source of information among respondents aged 55 and older (40 per cent) and only one in five among those between the ages of 18 and 44.

Usability of websites: banks perform better than insurance providers

If more people inform themselves online about financial services or insurance products, websites should be designed in a more user-friendly manner. Three figures show one thing: there is still room for improvement for insurance providers.

- 46 per cent of respondents say they have no problems navigating their insurance provider’s website

- 47 per cent find the website clear and well-structured

- 34 per cent can use their insurance provider’s website well on their smartphone

Banks score better on these aspects.

- 65 per cent say they can easily navigate their bank’s website

- 65 per cent find the website clear and structured

- 50 per cent can use their bank’s website well on their smartphone

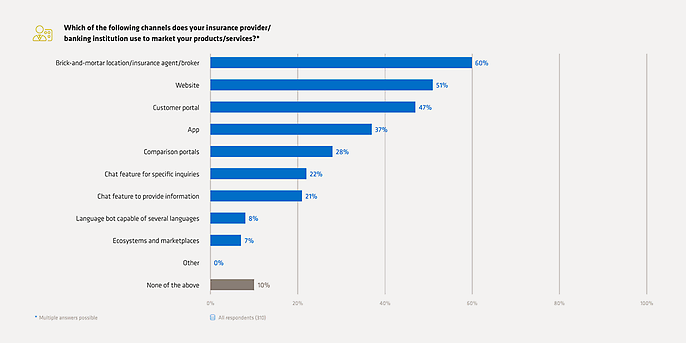

The interesting thing here is that 60 per cent of decision-makers at banks and insurance providers state that they sell their products and services locally in the branch or through agents/brokers, which means that online is not the number one distribution channel for them. The app scores comparatively poorly with 37 per cent, while the website is still at 51 per cent as a sales channel. In order to improve the customer journey, companies have set themselves a number of goals for the coming months. One in three decision-makers want to improve service offerings (33 per cent), 27 per cent say they want to revise their online/offline sales strategy and 13 per cent want to set up or optimise a chatbot.

An important insight from these figures is that banks and insurance providers are wasting sales opportunities on websites and mobile offers. The trend points to customers concluding contracts online more and more. In particular, the younger generation will increasingly use online channels in the future and sign contracts on them. Insurance providers urgently need to catch up when it comes to online offerings. Websites could be better structured, and mobile apps could be more inviting. The offers do not reach the customer base, even though it is already possible to conclude contracts online.

Quo Vadis digital commerce?

The digital commerce study includes many more questions than the ones I have given as examples. But they also show how big the gap is between what customers want and what is actually on offer. Specifically, it seems that sustainability has its price. Banks and insurance providers are not only gaining in reputation among their customers with sustainable products, they are also willing to pay more for them. When it comes to ‘online vs. offline’, products and services are predominantly purchased at the branch office, that is, offline. However, customers increasingly want solutions that are uncomplicated and offered online.

Financial service providers need to think ‘digital first’. And we can support you in this mentality. We advise banks and insurance providers for a better customer experience, regardless of whether on the Internet or in an app. We optimise digital platforms together with customers or will set them up from scratch. We support financial service providers in the technical transformation of their IT landscape. You can find our complete portfolio for banks and insurance providers on our website, including the names of the people to contact initially.

Quo Vadis digital commerce – this is the title of our study. Banks and insurance providers can decide for themselves where to go by taking customer needs into account. Those who adapt get to become major players. Those who are particularly good at it can even set the pace themselves – both for customers and for the competition. PayPal sends its regards! I hope you enjoy reading the study and that you gain good insights!

You can find even more exciting insights in our collection of blog posts on the topic of digital commerce.

You will find more interesting topics from the adesso world in our latest blog posts.