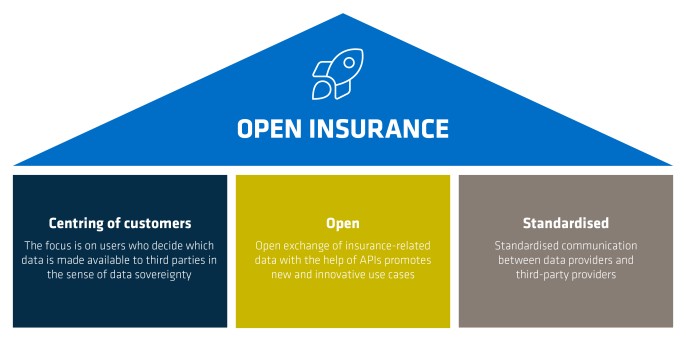

Sharing data gives rise to tailor-made offers and customer experiences and therefore to competitive advantages. With the entry into force of the EU’s PSD2 Payment Services Directive, open interfaces have already become established in the banking sector and have given the industry a real boost in terms of technology. The insurance industry, in comparison to the banking world, still has a lot of catching up to do in this regard.

However, in order for them to be able to participate actively and efficiently in digital ecosystems, open and standardised interfaces are also a basic requirement for insurance companies. The goal of such ecosystems is to integrate personalised offers as seamlessly as possible into policyholders’ respective sectors of life and broker’s everyday work by exchanging data with third parties and utilising data analyses – in the sense of data-driven insurance – and also to create added value together.