1. March 2023 By Claus Hartherz

Online identity verification: a comparison of three identification methods

When it comes to using digital identities, Germany is lagging behind. They are the key to digitalising administration, economy and society. Enormous potentials remain unused: administrative processes and private services could be simplified and costs could be saved by using optimised online identity verification. This blog post will take a look at the status quo and analyse which means and methods promise improvement.

The nPA: widespread, hardly used

The country’s new personal ID card (nPA, neuer Personalausweis) featuring an online ID card function (eID, electronic identification) has been available in Germany since 2010, but only just under ten per cent use this function (source: eGovernment Monitor 2022). Other European countries are already further ahead: according to Bitkom, 90 per cent of the population in Denmark use their eID almost daily. And in Estonia, every citizen has had a digital identity since 2002.

Huge potential for the state and economy

Digital identities hold great potential as an economic factor. According to the German Federal Ministry for Economic Affairs and Climate Action (Bundesministerium für Wirtschaft und Klimaschutz, BMWK), economies that have a well-functioning infrastructure for digital identities can increase their gross domestic product by three to four per cent. PricewaterhouseCoopers (PwC) predicts that from a global perspective, the market for digital identities is expected to grow to around USD 33 billion by 2025.

These figures indicate that something in Germany has to change. The EU has recognised this as well. It is pursuing the goal of having 80 per cent of citizens use an electronic identification solution by 2030. These solutions are needed so that sensitive processes can be conveniently handled in the digital environment – for example, official administrative procedures, opening a bank account or health insurance services.

Online identity verification methods: POS identification, video identification, eID

Secure online identification methods are a basic prerequisite for expanding digital services for sensitive transactions. There are different approaches in this regard; the following are the most common:

- 1. POS identification (point of sale)

- 2. Video identification

- 3. Online ID card function (eID)

They all offer the possibility to carry out identification checks in the digital environment, but they have different strengths and weaknesses. It is up to the provider to decide which method to use.

POS identification: the on-site check

With digital transactions, the customer and verifier are physically separated from each other. If, for instance, a customer wants to conclude a mobile phone contract online, the company must verify their identity beyond doubt. With the POS identification method, an agent on site at the point of sale bridges this spatial distance. A postal company often assumes this role.

Customers present their personal ID card or passport for identification. The correct transaction is assigned and their identity is verified, all on site. The photo comparison and the verification of the ID card, which are carried out by trained personnel using various security features, are what make this method secure. The customers confirm the process so that all the data can be transmitted and the contract can be concluded.

Identification via POS identification is the method that has been established the longest. It offers security benefits by using on-site personnel to carry out the identification process. In addition, the technical requirements are straightforward and personal contact is sometimes preferred. This is however counterbalanced by a high time requirement, as visiting points of sale that have limited business hours is something that must be done. And from a business perspective, POS identification is also costly and difficult to scale. As a result, POS identification contradicts the idea of end-to-end digitalisation.

Video identification: verification via camera

The video identification method is purely digital. The identification is done via video chat without the need for the customer and the verifier to physically meet. The only things that is needed is a PC, laptop or smartphone with a camera and Internet connection. The verifiers are all trained personnel. This makes this process comparable to the POS identification process. An identification document is compared with the person to be identified – but only in a video chat.

Video identification methods have been in use for years but became particularly popular during the pandemic. Credit institutions, insurance companies and mobile phone and mobility service providers are among those that offer video identification. The identification takes place as an intermediate step as customers use one of the actual transaction partner’s digital services.

The video method has the advantage that it can be used conveniently from anywhere. That being said, problems have arisen in the past. When demand was high, customers had to put up with long wait times. The user experience suffered and abandonment rates increased as a result. This problem is difficult to solve, as video identification requires trained personnel on the verification side. This leads to a shortage of resources and constitutes a relevant cost factor for companies.

In addition, in the summer of 2022, the German Society for Telematics Applications (Gesellschaft für Telematik Anwendungen, Gematik), which is responsible for the digitalisation of the German health system, suspended the video identification method until further notice due to concerns regarding security.

eID: the online function in the personal ID card

With the new personal ID card’s (nPA) online ID card function (eID), personal identities can be proven one hundred per cent digitally. The method is simple: if the online ID card function is activated, an NFC-enabled smartphone and the person’s personal six-digit PIN are all that is needed to identify themselves. A special ID card reader, which was needed years ago, is no longer absolutely necessary.

Verifying the eID is not done by a person, but rather by a licensed identification service provider. Its service is integrated into the actual transaction process via a web interface, which means the identification is completed within a few seconds. This makes the eID function not only convenient, but also secure, as this method is legally compliant and meets the strict requirements for electronic identification as defined in the eIDAS (electronic Identification and Trust Services) Regulation. In it, the eID is classified under the highest trust level ‘high’. The problem with the eID is that it has been used very little up to now. There are two reasons for this. One of them is that the eID is offered as an identification method too rarely, especially by companies, and the other is that the existing methods are not very user-friendly.

In light of its great potential, authorities and companies should at least consider offering eIDs. The technical effort and required amount of human resources are low, and the fully automatic system is easily scalable. It is therefore a cost-effective solution with the highest level of security available.

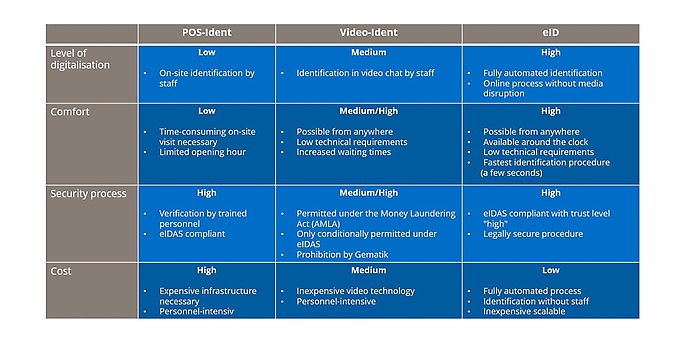

Identification methods at a glance including an evaluation of them based on selected characteristics with individual classification into the general categories Low, Medium and High. (Source: adesso SE)

Conclusion: identity verification via the online ID card function (eID) has great potential

There are various methods for verifying people’s identities in digital processes. What they have in common is that they can make a valuable contribution to advancing the digitalisation of society. However, the methods are established differently and have their respective advantages and disadvantages. Table 1 gives an overview of where these advantages and disadvantages lie. A closer look shows that identity verification via the online ID card function (eID) presents the best solution to leverage the existing digital and economic potential. Not only does it offer an automated digital process with maximum convenience, but its high level of security, which protects both the clientele and the company, is highly compelling. This fulfils the basic prerequisite for gaining customers’ and citizens’ trust. The costs are comparatively low.

The problem with the eID is its use and familiarity. Attractive offers that convince customers to choose them due to their high level of user-friendliness are lacking. Companies can change this. Doing so requires stakeholders who lead the way and offer a smart eID method that can be used on all channels. This would win over new customer groups, achieve lower abandonment rates and strengthen the competitive edge.

You will find more exciting topics from the adesso world in our latest blog posts.